Navigating Beneficial Ownership Regulations with CIPC

From Only R1800 - price will be quoted based on number and nature of shareholders (natural persons / Companies and Trusts)

As of December 11, 2023, filing Beneficial Ownership information with CIPC is mandatory for businesses submitting their Annual Returns (if not previously provided). This update was announced in Notice 67 of 2023, outlining the latest requirements.

Implications for You:

Ensure Your Company Stays Registered: Keeping your Beneficial Ownership information updated is now essential for submitting Annual Returns with the CIPC. This requirement will be gradually introduced across all annual return platforms and becomes mandatory on April 1, 2024.

Steps to Safeguard Your Business:

Understanding Beneficial Ownership at the CIPC

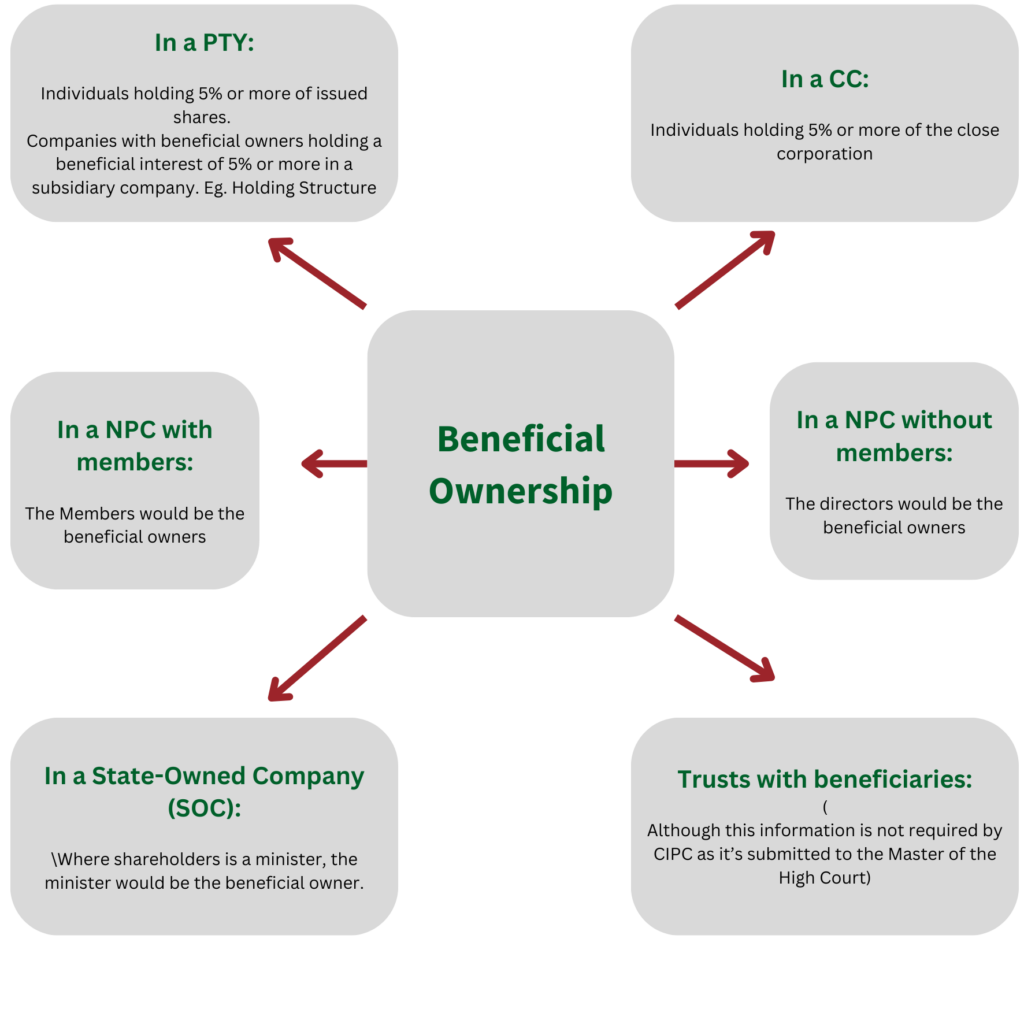

A Beneficial Owner of a company refers to an individual who ultimately owns or has effective control over the company, either directly or indirectly.

Here’s an example:

For example, John owns 60% of the shares in Company ABC, granting him a majority vote in decision-making and the authority to appoint or remove board members. Furthermore, through indirect ownership via a holding company, he can influence the management and strategies of Company ABC. As a result, John is classified as the ‘beneficial owner’ of Company ABC, and his information will be recorded in the Beneficial Ownership Register.

Who Are the Beneficial Owners?

Why was Beneficial Ownership Regulations implemented in South Africa?

Previously, companies were not required to disclose their Beneficial Ownership or shareholding details to entities like the CIPC. These matters were treated as confidential and managed internally through share registers, shareholder agreements, and similar documents.

However, in line with new regulations introduced by the South African Government, the CIPC has clarified that it has worked closely with regulatory and law enforcement agencies to establish a system for collecting and cross-referencing Beneficial Ownership information. These agencies include the South African Revenue Service (SARS), the Financial Intelligence Centre (FIC), and the Financial Sector Conduct Authority (FSCA).

This new requirement now mandates companies to disclose their Beneficial Ownership details to the CIPC, ending the era where hidden interests in a company could remain undetected. It has significant implications for individuals holding valuable assets or complex ownership structures. With these regulations, government bodies like SARS are empowered to scrutinize ownership arrangements thoroughly and take action where necessary.

When is the deadline for filing Beneficial Ownership at CIPC?

The deadline for submitting the initial Beneficial Ownership register to the CIPC was six months after the regulation was announced, giving companies limited time to finalize their ownership structures and meet the new requirements.

Companies registered before May 24, 2023, must include their Beneficial Ownership register as part of their annual return filing. Companies registered on or after May 24, 2023, are required to complete their Beneficial Ownership register within 10 days of incorporation.

The CIPC has emphasized that failure to submit Beneficial Ownership information will be considered non-compliance and may result in a court-ordered administrative fine, either 10% of the company’s turnover or R1 million, whichever is greater.

This adds a significant burden on South African businesses.

Thankfully, our team of specialists can help you file your Beneficial Ownership register with the CIPC at a minimal cost.